Will add about $7 per month for the average household

The 2026 Niagara Falls Tax Levy Budget has been approved, which means a 2.4% increase to the Operating Levy and a 2.0% increase to the Capital Levy.

A residential home with an average assessed value of $280,000 will see an increase of $77.56 per year, or $6.46 per month.

64% of Niagara Falls homes are assessed at $280,000 or less, although property assessments have not been updated in 10 years.

Capital Levy

- $36.77, or 47% of the annual increase, will be invested in roads.

- A $2,038,500 capital budget amendment to the Shave & Pave program will allow the City to repair an additional 4.13 km of roads.

Operating Levy

- $40.79, or 53% of the annual increase, supports City operations, including inflationary adjustments and targeted investments in:

- Sidewalk repairs to improve safety and accessibility.

- Storm sewer maintenance to increase CCTV inspections, flushing and catch basin cleanings.

- Modern software and cybersecurity to protect digital systems and ensure reliable services.

Belugas at Marineland Holding....

Belugas at Marineland Holding....

NDP Leader Stops in Niagara

NDP Leader Stops in Niagara

Region Finds Potential Budget Savings

Region Finds Potential Budget Savings

Man Killed in Tent Fire

Man Killed in Tent Fire

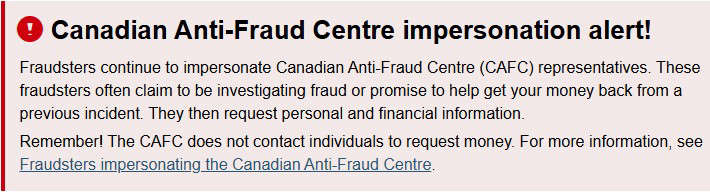

Police Warn of Another Scam

Police Warn of Another Scam

3 Drivers Handed Licence Suspensions

3 Drivers Handed Licence Suspensions

Outrage Over LTC Home Closure Intensifies

Outrage Over LTC Home Closure Intensifies

Extended Long Weekend for Students

Extended Long Weekend for Students